How to take out a loan?

Borrow money for any purpose in the currency of your choice. It only takes a moment to complete the application form.

A few simple steps

Have a good look at the offer. Everything you need to know can be found on our website.

You are only a few steps away from receiving money for whatever it is you have planned. Simply, fill in the application form with basic information about yourself and your income. Wait for a decision.

You will not wait long for your application to be processed. If the decision is positive, you will receive the money according to your bank account.

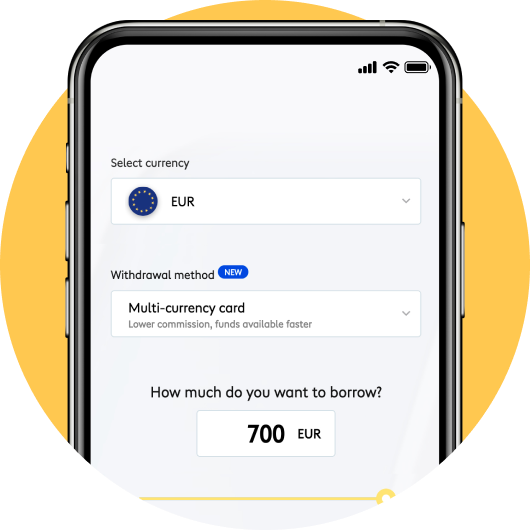

Choose the currency, amount and period

Select the currency and amount you want to borrow and then specify how quickly you want to pay it back.

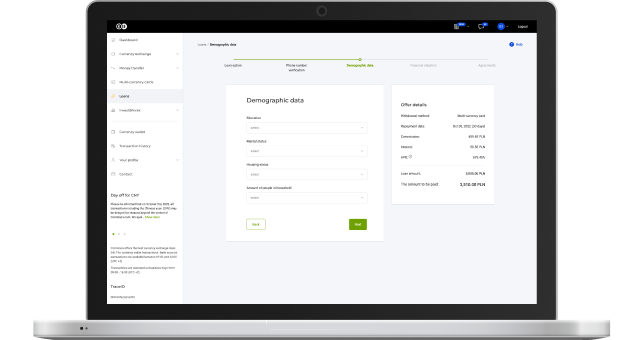

Complete the application form

Fill in the application form with basic information about yourself. This allows us to check whether the repayment of the currency loan is not too much of a financial burden for you.

Await the decision

Wait for the decision on granting the multi-currency loan. We understand that time is of the essence, you will be informed about it as soon as possible.

Start implementing your plans

After your application has been accepted, we will send the money according to your bank account.

For details about the multi-currency loan, go to your user panel.

Repay according to the schedule

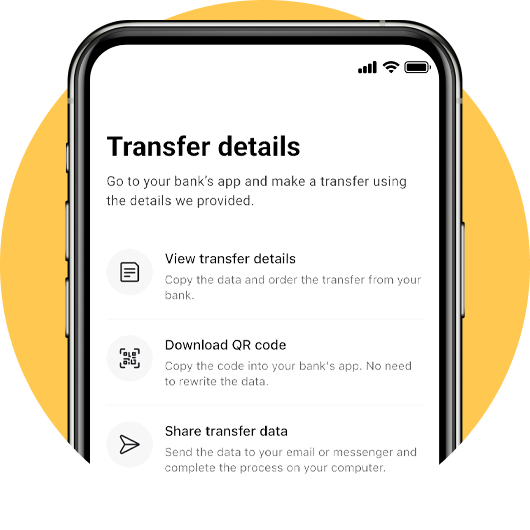

- You will find the transfer details for your loan repayment in your customer panel.

- For your convenience, we will remind you of the repayment deadline

You will find the transfer details for your loan repayment in your customer panel and in the frequently asked questions.